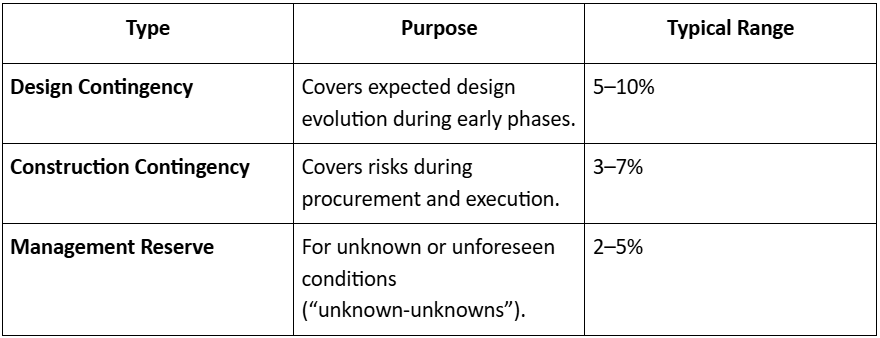

Even the best-prepared estimates include uncertainties. Hence, contingency planning ensures financial resilience.

1. Understanding Risk in Estimates

Common risk sources:

- Incomplete scope definition

- Market fluctuations in materials and labor

- Design errors or late design changes

- Site or geotechnical surprises

- Regulatory or environmental delays

2. Types of Contingencies

3. Risk Quantification Methods

- Percentage Method: Add a fixed % of the base cost (simple but less scientific).

- Expected Value Method: Expected Risk Cost = Probability × Impact

- Monte Carlo Simulation: Runs multiple probabilistic simulations to define best and worst-case outcomes.

4. Sensitivity Analysis

Test how changes in key assumptions (e.g., material rate, productivity) affect total cost.

This identifies high-impact variables that require close monitoring.

Golden Rule:

It’s a planned reserve for specific, measurable risks.