The Contractor Contract section enables organizations to formalize agreements with contractors by defining contract details, values, deliverables, terms, and legal clauses. It ensures compliance, streamlines financial tracking, and establishes clear expectations between the organization and contractors.

Navigation Path

- Log in to the application.

- Go to the left menu and click Contractor.

- Click on Contract.

- Click the Add Contract button.

Form Field Details

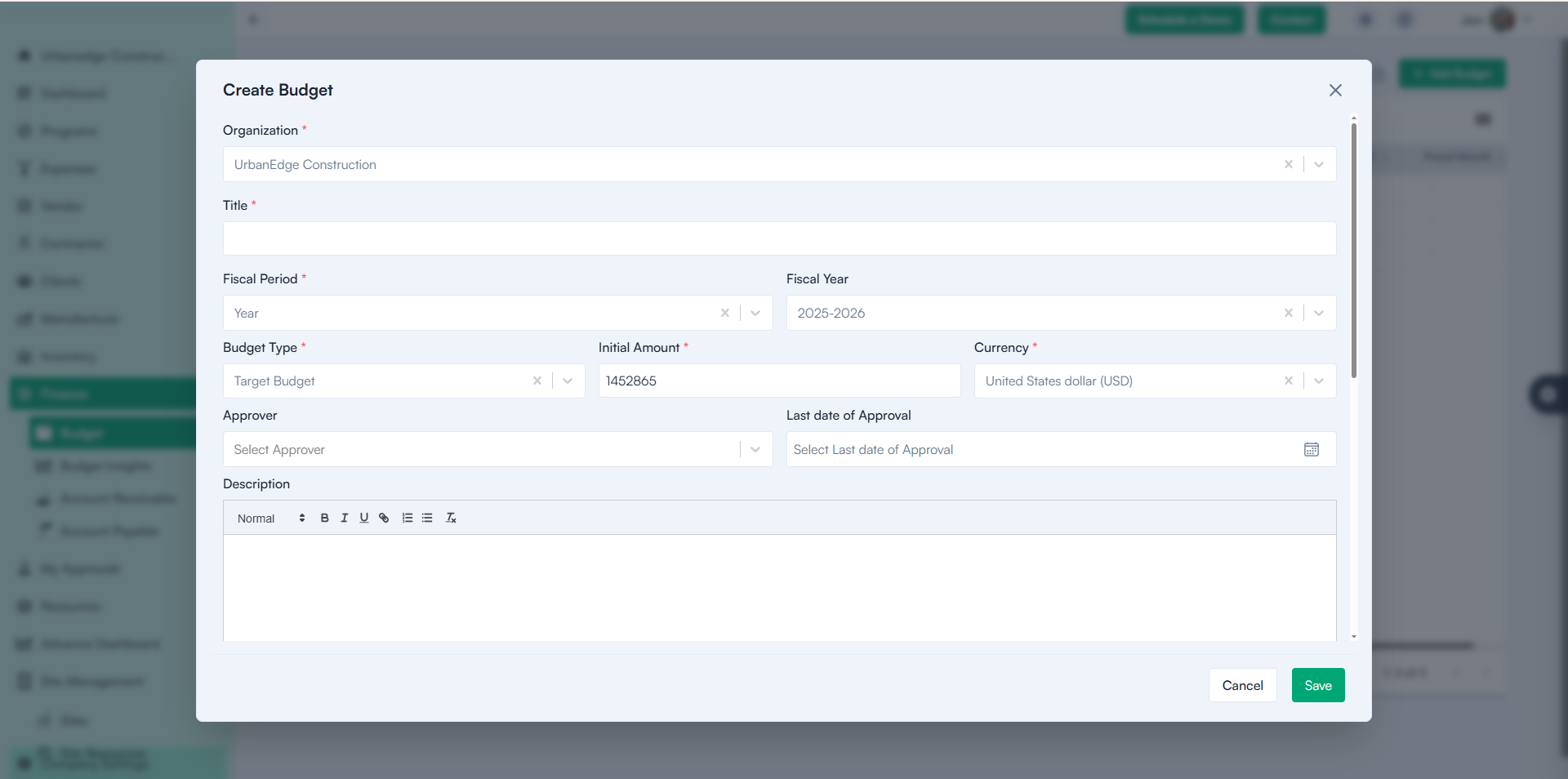

Create a Contract – Steps

1. Select Project Name

Choose the project associated with this contract from the dropdown.

2. Select Contractor/party Name

Select the contractor from the Party dropdown.

3. Select Contact

Choose the appropriate contact linked to the selected contractor.

4. Contract Name

Enter a name for the contract.

5. Contract Type

Select the type of contract from the dropdown.

6. Contract Status

Default status is set to Draft.

7. Date Range

Select the start date and due date from the calendar picker.

8. Currency Code

Select the currency in which the contract value is defined.

9. Tax Selection

Choose applicable taxes from the dropdown.

(Configured in Company Settings ➝ Finance Settings ➝ Tax)

10. Payment Terms

Select payment terms from the dropdown.

(Configured in Company Settings ➝ Finance Settings ➝ Payment Terms)

Contract Value

- Enter the total contract value.

Tax Amount & Total Contract Amount

- Calculated automatically based on the entered contract value and tax rate.

Select Approver

- Choose the approver from the dropdown.

(Configured in Company Settings ➝ Organization Settings)

Contract Execution Date & Review Date

- Enter the dates for contract execution and review.

Contract Deliverables

Define expected deliverables by filling in:

- Deliverable Name

- Deliverable Date

- Additional Notes

- Deliverable Description

Contract Terms

Specify detailed contract terms, including:

- Term Name

- Term Number

- Term Type (Payment, Delivery, Penalty, Add Deliverable)

- Date

- Amount

- Currency

- Term Description

Jurisdiction Name & Legal Clauses

- Enter the legal jurisdiction and include relevant clauses.

Parameter Selection & Attachment Upload

- Select additional parameters and upload supporting documents.

Action Buttons

- Save – Stores the contract record.

- Cancel – Discards any entered data and exits the form.

Note: For Creating a Contractor Contract

Mandatory Fields:

- Project *

- Party *

- Contact *

- Contract Name *

- Contract Type *

- Currency *

- Tax *

- Payment Terms *

- Contract Value *

- Approver *

Actions Available per Record

- View – See contract details.

- Edit – Update contract information.

- Contract Template – Access predefined templates.

- Delete – Remove the contract record.

Additional Features

- Contract status determines eligibility for generating Work Orders.

- Clicking the contract name redirects to the Contract Details Page with complete information.

Contract Details Page – Additional Options

- Print Preview – Generate a printable version of the contract.

- Add Signature – Insert digital signatures.

- Terminate – End the contract before its due date.

- Add Appendix – Attach supporting documents.

- Add Amendment – Record changes to contract terms.

- Audit Log – Track updates, approvals, and history for compliance.

Contractor Contract KPI’s

- Total Contracts – Displays the total number of contracts.

- Total Contract Value – Sum of all active contracts.

- Outstanding Amount – Tracks unpaid or pending balances.

- Pending Contracts – Contracts awaiting review or approval.

- Retention Held – Displays retained amounts as per contract terms.

- Expired Contracts – Contracts that have passed their validity date.